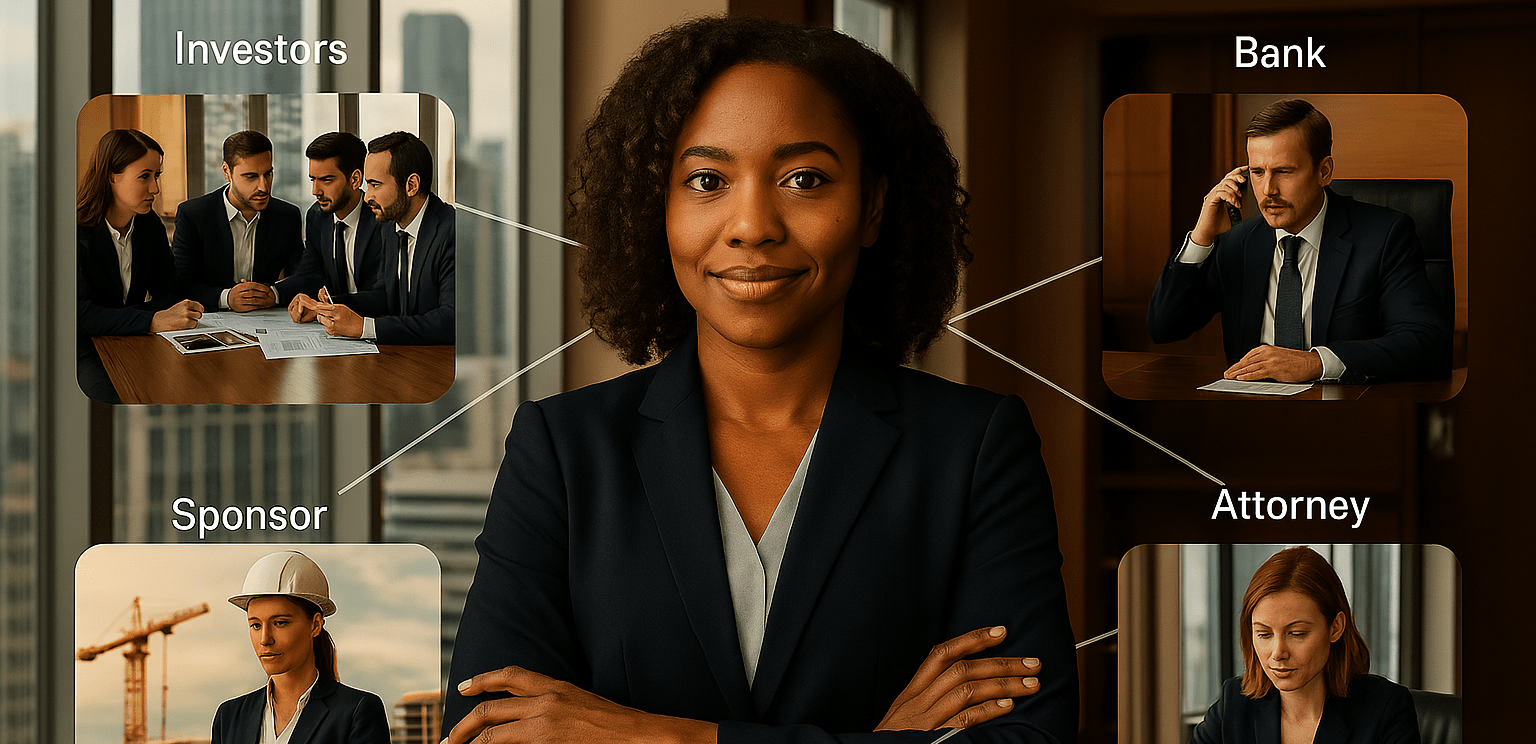

Bookkeeper vs. Outsourced CFO: Who Does What in Private Equity Real Estate?

Bookkeepers focus on transactional accuracy, while outsourced CFOs provide the strategic oversight and financial leadership required to scale a private equity real estate business. Understanding the difference between these roles helps sponsors avoid common financial bottlenecks as deal complexity, investor expectations, and reporting requirements increase. Choosing the right level of financial support at each stage … Read more