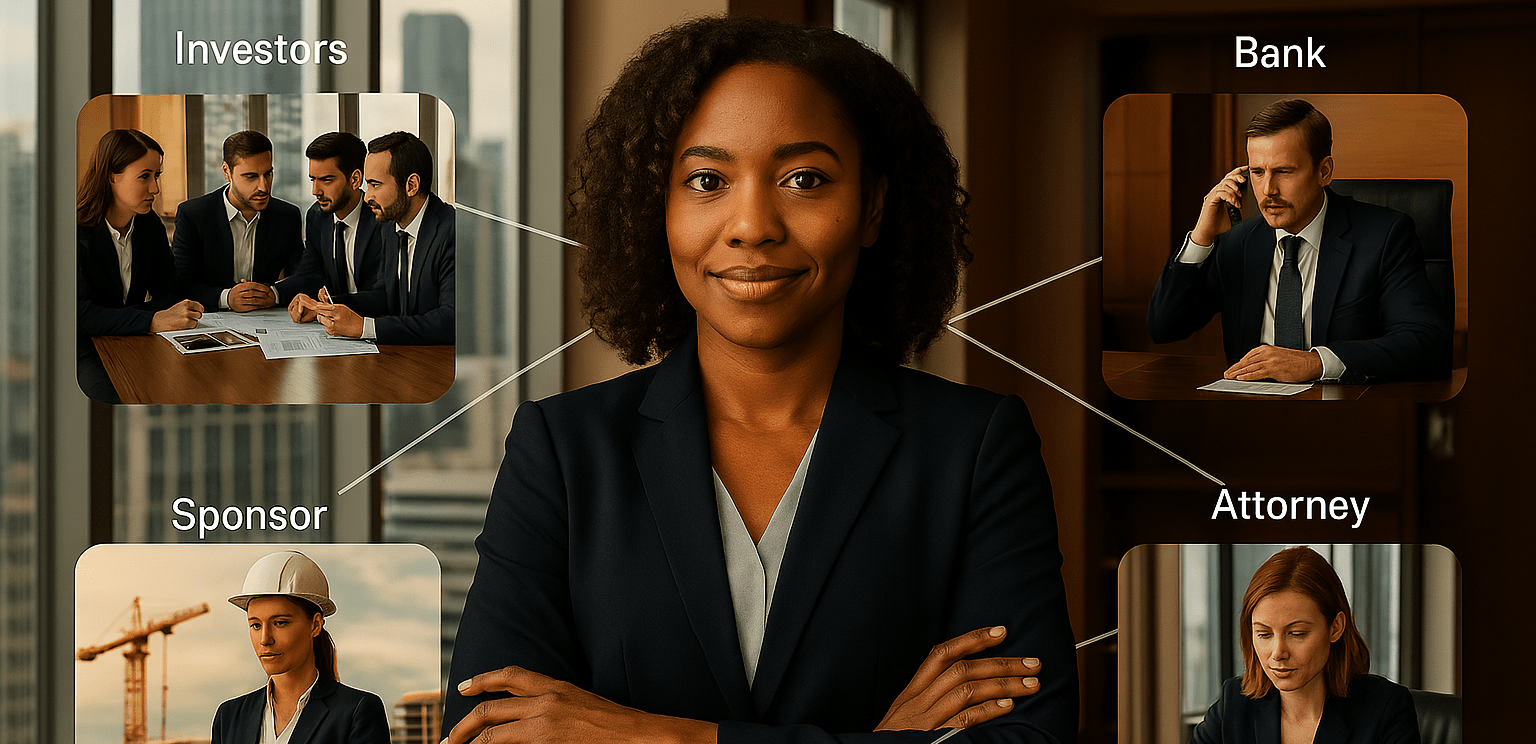

Building a Scalable Capital Raising Engine: The Tools and Processes Sponsors Need Before Going to Market

Capital raising moves faster and builds more investor confidence when sponsors prepare institutional quality workflows before launching a raise. Offering documents that use consistent terms, economics, and definitions across the operating agreement, PPM, and subscription package reduce investor confusion and help to prevent common fundraising bottlenecks. Smooth subscription execution and a disciplined onboarding workflow create … Read more