5 Reasons Why Private Equity Real Estate Sponsors Underutilize Investor Management Platforms

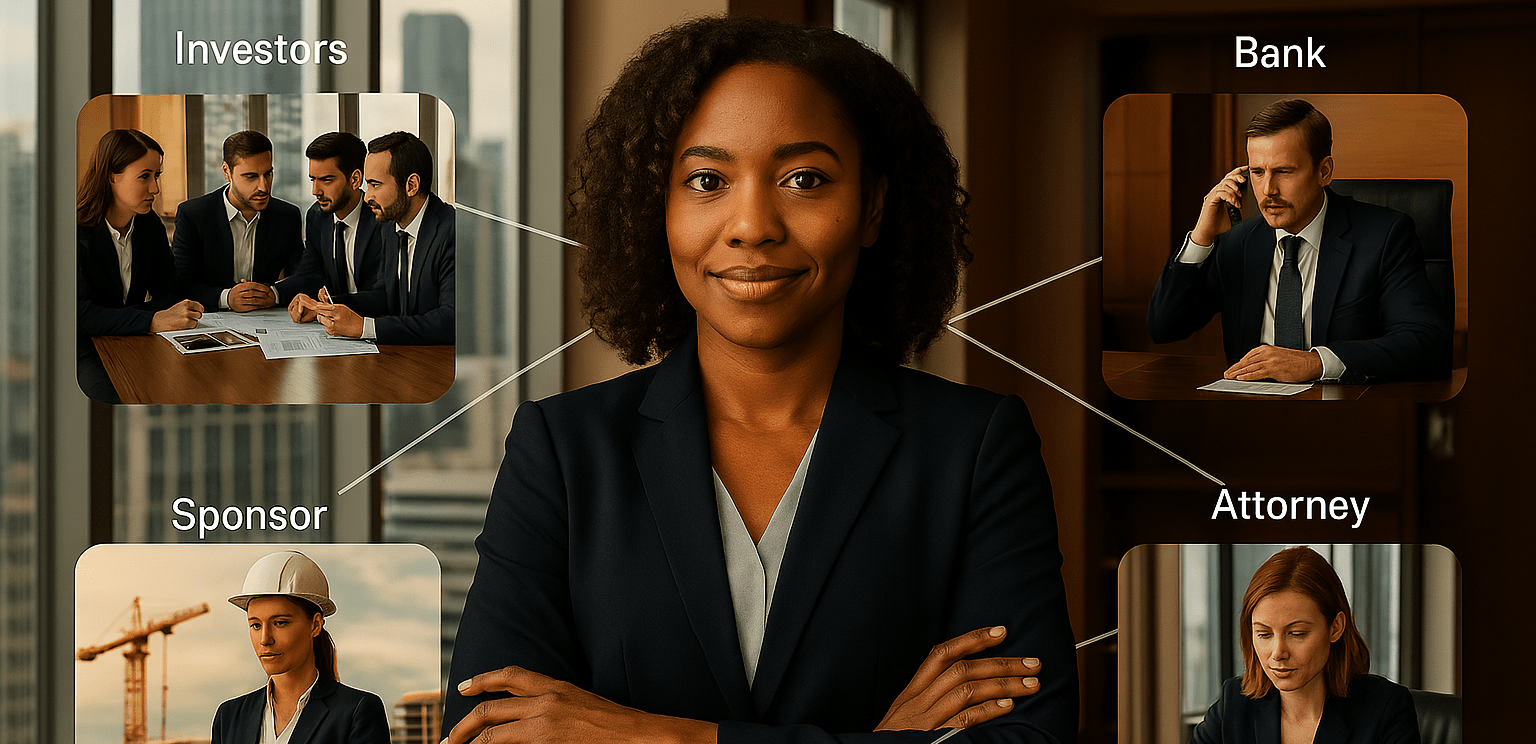

Sponsors often invest in investor management platforms but fail to properly implement the software, leaving the tools underutilized. Poor system documentation, unintuitive user interfaces, and lack of experience make adoption difficult and discourage regular use. Without proper implementation, maintenance, and controls, sponsors tend to lose confidence in investor managements platforms and revert to manual processes. … Read more