- Capital raising moves faster and builds more investor confidence when sponsors prepare institutional quality workflows before launching a raise.

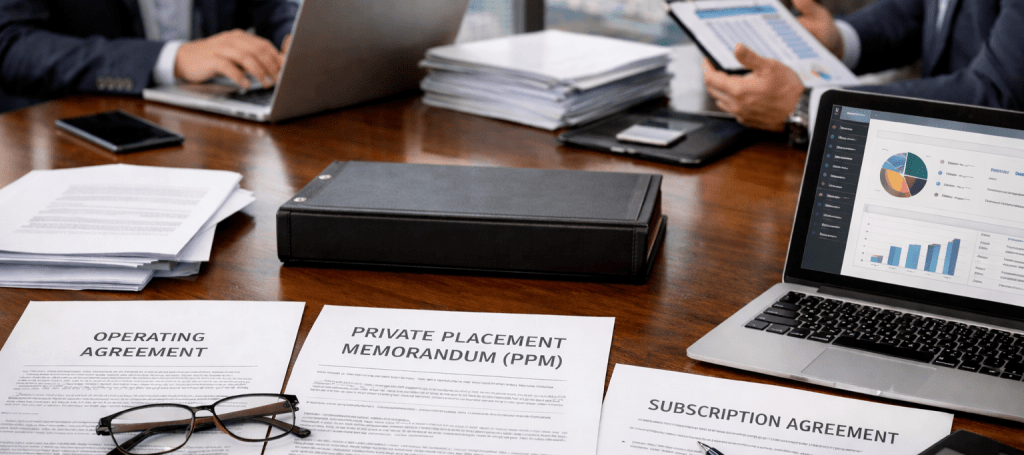

- Offering documents that use consistent terms, economics, and definitions across the operating agreement, PPM, and subscription package reduce investor confusion and help to prevent common fundraising bottlenecks.

- Smooth subscription execution and a disciplined onboarding workflow create a predictable investor experience and limit delays caused by missing documents or unclear instructions.

- A CFO services firm can own the back office work that underpins the entire fundraising process, allowing sponsors to focus their time on investor relationships rather than administration.

Raising capital in the private equity real estate industry has become a test of operational strength as much as investor relationships. Sponsors used to rely on personal networks, a polished pitch deck, and a compelling story. Today, investors expect clean processes, clear documentation, and a frictionless onboarding experience. Sponsors who build institutional quality workflows before they go to market create a smoother path from commitment to funding, which can shorten closing timelines and strengthen investor relationships.

A common pattern that we observe in successful raises is preparation. When the back office is organized, aligned, and ready to handle investor interactions, the fundraising process feels steady and predictable. Investors sense the structure behind the scenes, which gives them confidence that the sponsor will manage capital with the same level of discipline.

There are several areas where sponsors can focus on preparation to build a scalable fundraising engine.

Coordinating Legal Partners and Document Preparation

A smooth raise starts with legal coordination. Fund formation attorneys play a critical role, but sponsors need to bring them in early and keep communication tight. When offering documents are still moving targets late in the process, document churn becomes inevitable. That churn can create downstream confusion for both the sponsor and prospective investors.

The operating agreement, PPM, and subscription documents must align with each other. When sections refer to the same fee, waterfall, or governance term, the language should match. When they do not, investors notice, and the sponsor loses credibility. Consistent documents also reduce the number of revisions needed in the investor portal and prevent version control problems after launch.

Sponsors should also prepare for investor questions on the offering structure and underlying underwriting. Investors will ask why certain terms exist, how fees work across different classes, and what assumptions drive the projected return. Having clear explanations ready saves time and keeps the raise from stalling. It also signals that the sponsor has thought through the structure and its implications for LPs.

Turning the Investor Management Platform Into a Scalable Fundraising Hub

A well-configured investor management platform shortens the path from offering launch to funding. Instead of managing dozens of email threads and tracking commitments manually, the portal becomes a centralized environment where investors can review documents and submit subscriptions. Across the industry, LPs have come to expect this level of organization, even from middle-market sponsors.

The deal room is the first impression. It should be structured, complete, and easy to navigate. Achieving this helps to reduce repetitive questions from investors and ensures that pertinent information is communicated early in the process.

Setting up the raise requires experience and specialized knowledge about the software platform and the offering structure. Entity mapping, investment classes, minimums, wire instructions, and cap table logic must be set before launch. Funding settings and signature sequencing also matter because errors cause delays at inopportune times.

Centralizing communications through the portal ensures that all investors are receiving key information at the same time. Automated notifications help investors stay engaged without constant manual follow up.

Building Subscription and E-Signature Workflows That Reduce Friction

Subscription agreements are a common point of failure. Even small errors can derail progress and create back and forth with counsel and investors. Properly built e-signature templates eliminate most subscription issues by guiding investors through required fields.

Automated status updates give sponsors visibility into investor progress. Instead of tracking manually, teams can see who has viewed documents, completed signatures, or initiated funding.

Designing a Smooth Investor Onboarding Experience

Onboarding is where most fundraising delays occur. Investors may be committed, but missing documents or unclear instructions halt progress. Coordinating accreditation documents, entity paperwork, W-9 forms, tax forms, and bank linkages requires early planning and a team that enters the raise armed with clear roles and responsibilities.

A well-designed onboarding workflow reduces touchpoints. Investors appreciate clarity and speed, while sponsors reduce administrative drag during a raise.

Managing Investor Communications Throughout the Raise

LP-friendly messaging improves the investor experience. Clear communication minimizes confusion and accelerates commitments. A predictable communication schedule keeps investors informed. Announcements for launch, reminders, progress updates, and final close reduce uncertainty and inbound questions. Automated workflows for reminders and portal notifications keep investors engaged without overloading the sponsor’s team.

How a CFO Services Firm Fits Into The Fundraising Process

Sponsors often underestimate the level of back office work required. A CFO services firm fills this gap by configuring the investor platform, building deal rooms, and preparing subscription templates. These teams also manage onboarding workflows and coordinate with attorneys to ensure clean integration between documents and the fundraising process.

A CFO services firm can take ownership over key pieces of the fundraising process, which allows the sponsor to focus on building relationships with capital providers.

Final Thoughts

Scalable capital raising depends on operational readiness. Investors expect a streamlined and predictable experience from the moment an offering is introduced. Sponsors who invest in systems and structured workflows remove the friction that tends to slow commitments and causes confusion. A strong back office is not something that investors always see directly, but they feel its impact in every interaction.

Lexcraft Advisors is a CFO services firm that supports middle market real estate funds and syndications. Our team takes pride in providing sponsors with reliable financial operations solutions that mitigate risk and facilitate growth. To learn more about our services, schedule a complimentary meeting with our Managing Partner.